05 ago What Is Earmarking? What It Means, How It Works, and Examples

In 2005, members of Congress pushed to defund the bridge and divert the money to rebuild a bridge destroyed by Hurricane Katrina, but Senator Ted Stevens (R-Alaska) threatened to quit Congress if the earmark was scrapped. The dashboard will also be accompanied by Guiide’s tracking tools showing how a person’s long-term plan is affected as they draw income and as their live pension pot values vary over time. The Glasgow FinTech said pension freedoms are great but leave many with a large risk of running out of money. So given this, Guiide believes people need the right tools to plan and manage their retirement income themselves, rather than just “wing it” on their own. Founded in 2021, Peachy’s all-in-one platform gives customers access to private health coverage, find local specialists and have digital access to GPs via phone and video chat.

R-5 Zone case: Supreme Court to hear Amaravati farmers’ SLP next week – The Hindu

R-5 Zone case: Supreme Court to hear Amaravati farmers’ SLP next week.

Posted: Mon, 08 May 2023 07:00:00 GMT [source]

Participation also came from Up2 Opportunity Fund, Hestia Investments, and Yugen Partners, as well as follow-on investments from Mighty Capital, Alpha Edison, and Think+ Ventures. All these funds also purchased ORE Tokens in order to take a stake in the ORE Network. The round was led by institutional blockchain investment firm Morgan Creek Digital.

Big deals dominate 31 FinTech deals this week

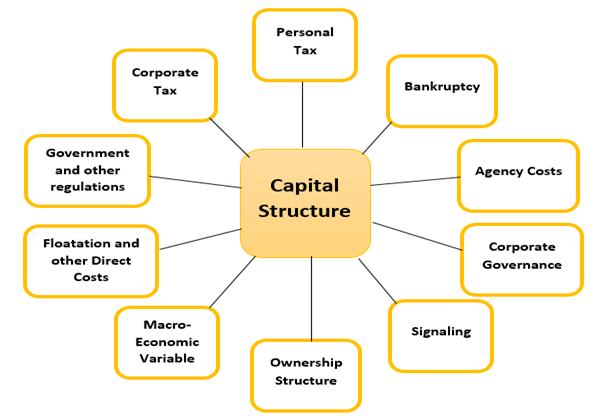

Earmarking ensures that the funds will go to the intended creditor, rather than being subject to claims by other creditors who have preference in the bankruptcy proceedings. The doctrine is based on the idea that, because there was no net decrease in the bankrupt party’s asset base, the funds never really belonged to the bankrupt party; they “borrowed from Peter to pay Paul.” Therefore, money earmarked for a loved one will be treated more carefully than money for a friend. Likewise, people may be more willing to lend money to somebody they trust than a stranger.

Inclined, a FinTech aiming to help whole life insurance policyholders realise more value of their policies, has raised $15m in Series A funding. 3Commas, an automated crypto trading bot investment platform, has collected $37m in its Series B funding round. The company said the funding will expand its shareholder base, enhancing its balance sheet as the it focuses on driving strong cash flow in the near term. This will also enable further investment in new technologies and strategic initiatives, enhance its multi-payer marketplace, and expands its Encompass platform, a technology-driven approach to purchasing Medicare Advantage plans. The company stated the agreement will significantly reduce SeQura’s funding cost and will allow SeQura to further its investment into strategic and high-growth initiatives to support its mission of being the preferred partner to merchants.

- Toqio’s Marketplace provides a place to incorporate curated fintech modules into a solution, offered by leading financial service providers.

- Under the RBI’s priority sector lending (PSL) norms, banks have to allot 40 per cent of their loans to segments earmarked by the Centre as strategic.

- The sale covers the consumer banking businesses of Citibank India, which includes credit cards, retail banking, wealth management and consumer loans.

- He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

I spent time in Costa Rica, the Dominican Republic, Haiti, Ghana, India and elsewhere, soaking up culture and languages. I lived in hostels, one-room apartments and homestays, and worked as an English as a Second Language (ESL) teacher to afford this globe-trotting lifestyle. Citi on Wednesday announced an agreement with Axis Bank Ltd for the sale of its consumer businesses in India for $1.6 billion. Following the Mega FinTech Accelerator, Citi will further assess the potential viability of the earmarked solutions, with the possibility of forging formal partnerships in the future. Finally, some consider the costs of earmarking to be negligible compared to the costs of the gridlock Edsall described.

Terms and Conditions Citibank Account

Also taking part in the round were Aldea veNTURES, Seaya, Speedinvest, SIX FinTech Ventures and a number of angel investors. Gaja Capital, Arkam Ventures and Vertex Ventures served as the lead investors to the round. 3Commas will also enhance developers’ access to Application Programming Interfaces (APIs) to create apps used by 3Commas traders within the ecosystem. Workstream, a mobile-first hiring and onboarding platform for the deskless workforce, has extended its Series B round with an additional close of $60m, bring the total raised in the round to $108m.

It was exciting and fulfilling, but when my 30s rolled around, adventure took a backseat to security. I also took gigs outside of my full-time positions as a teacher and later a school administrator to pay off massive student loan debt, build an emergency fund and maximize my retirement contributions. Today, the Citibank credit card programme is seen as a key addition to Axis Bank’s portfolio. The Citi Innovation Lab in Singapore is part of Citi�s Global Innovation Lab Network. The Labs serve as change agents, driving innovation and making it mainstream by co-creating and collaborating with internal partners, clients, as well as the broader FinTech ecosystem.

Bootstrap Your Wallet — and Your Life

Hong Kong-headquartered PayTech startup KPay Merchant Service has raised $10m in a funding round. AIKON is a B2B partner that builds solutions on the ORE Network, which is a blockchain that allows developers to build cross-chain solutions and is powered by the utility token, ORE Token. Champ Titles, which provides title and registration software to insurance carriers, has raises $12.9m in Series B funding. The company’s customers include category leaders in grocery, retail, convenience stores, manufacturing, lending and transportation. Inclined’s initial focus is to work with whole life advisors to offer policyholders a secured, revolving line of credit collateralized by the cash value in their whole life policy, within a fully automated experience. The Inclined Line of Credit (“iLOC”) is flexible in that it can be drawn or paid back iteratively at the convenience of the borrower.

While Citi will continue to operate its institutional client businesses in India, its exit from the consumer banking business marks the end of an era for the global banking giant, which has been present in India for 120 years now. Initiatives like the Mega FinTech Accelerator complement our global network and extensive product development efforts by solving for last-mile gaps and providing tangible value to our clients. The problem statements we chose to focus on represent consistent themes across multiple markets. As the payments landscape continues to evolve at an ever faster pace, partnership with fintechs become increasingly important,� said Scott Southall, Asia Pacific Head of Innovation, Treasury and Trade Solutions, Citi. The company also provides digital capabilities and transformation services using a library of APIs that give embedded insurance partners, InsurTech’s, MGAs and others access to potential business channels to launch insurance programmes.

Citi Mega FinTech Accelerator Explores Solutions for the Digital Economy

Bridge Money, a FinTech looking to empower lower income Americans earn supplemental income, has raised $5.8m in seed funding. Last year, the company launched its first electronic payment service to provide a one-stop transaction payment solution to merchants. The Smart POS Terminal accepts up to 14 major payment channels, including Visa, Mastercard and UnionPay. This capital injection will enable the company to bolster its product development efforts and bolster its regional expansion.

Remofirst’s services include onboarding, payroll, benefits, taxes and local compliance. PolicyMe said the funding will accelerate its development of a comprehensive suite of products that will be distributed via direct-to-consumer and B2B2C channels across large membership and employee groups. At inception, the company first tackled distribution with the initial launch of its coverage calculator and price comparison platform, and then launched a fully underwritten digital product in March of last year with Canadian Premier Life Insurance Company. Additionally, it is hiring a robust research and development team to create DeCommas, a recently launched subsidiary which provides users with easier access to trade automation in decentralised finance.

Liberis is also backed by investors such as FTV Capital and UK-based venture builder Blenheim Chalcot. Today, 3 million consumers and 200k merchants use Satispay, including small stores but also big brands such as Esselunga, Auchan, Benetton, Carrefour, Boggi, Trenord, Eataly, McDonald’s Tigotà, Autogrill, Trenitalia and many more. Satispay describes itself as the mobile payment network alternative to credit and debit cards. The case introduces the problems confronting Grasim Industries Ltd. situated at Madhya Pradesh, India, in the interest cost reduction and how it achieved one of the best cost competitive strategies. The case examines how with the help of a bank, the company introduced Cash Management System, negotiated with different banks, used alternative mode of finance and finally succeeded in reducing a substantial interest cost. For example, in my 20s, I valued independence and adventure, so I focused my energy and money on budget-friendly solo travel.

‘Food Street’ to come up near Uzhavar Santhai in Tiruchi – The Hindu

‘Food Street’ to come up near Uzhavar Santhai in Tiruchi.

Posted: Sun, 29 Jan 2023 08:00:00 GMT [source]

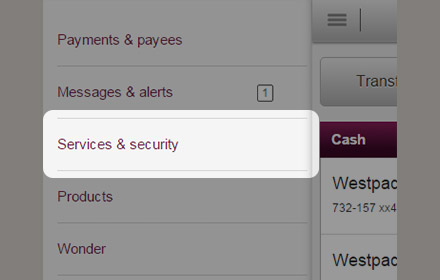

The company aims to make it simple for customers to understand what they are paying for and why. PolicyMe, a digital-first insurance provider on a mission to deliver simple and affordable insurance for Canadian families, has raised C$18m in Series A funding. Shaype’s platform provides single API earmarking amount in citibank india access to a wide-ranging suite of microservices for payments, KYC, data, insights and real-time transaction monitoring. It recently added to its securities offering by extending its lifecycle management through its new claims network and the launch of a ground-breaking predictive fails service.

You Can Build a Portfolio You Love and Invest Responsibly

According to Finextra, the company is planning to roll out new services for financial services, PropTech, HR and government before the end of the year. The company claims it offers a cost-effective, SaaS cloud-native offering with flexible modules that are ready-to-go. Shaype, an embedded finance platform, has raised A$33m in a Series C funding headed by Regal Funds Management. This is a collaboration network that allows for resolution and decision-making to be complete from one place.

Similarly, you may notice that variable or mutable costs like monthly magazine subscriptions, streaming services, unused data plans or eating out are wasting money. Instead, earmark those funds to enroll in personal development classes, host monthly dinner parties, build a website around your freelance services or dip your toe into the world of investing. Stere said the funding will allow it to further expand its capacity trading platform, a one-stop-shop for businesses to build and launch insurance programmes with capacity partners. Remofirst, a company which provides services to help companies build remote teams, has raised $14.1m in seed funding. This recent fundraise follows a successful 2021 for the company, during which it raised $5.5m and was named one of Fast Company’s Most Innovative Companies.

No Comments